Managing employee payroll can be a time-consuming task for any business. However, with the help of an Excel Payroll Template, this process can be streamlined and simplified. Excel is a widely used spreadsheet program that offers customizable templates for various purposes, including payroll management.

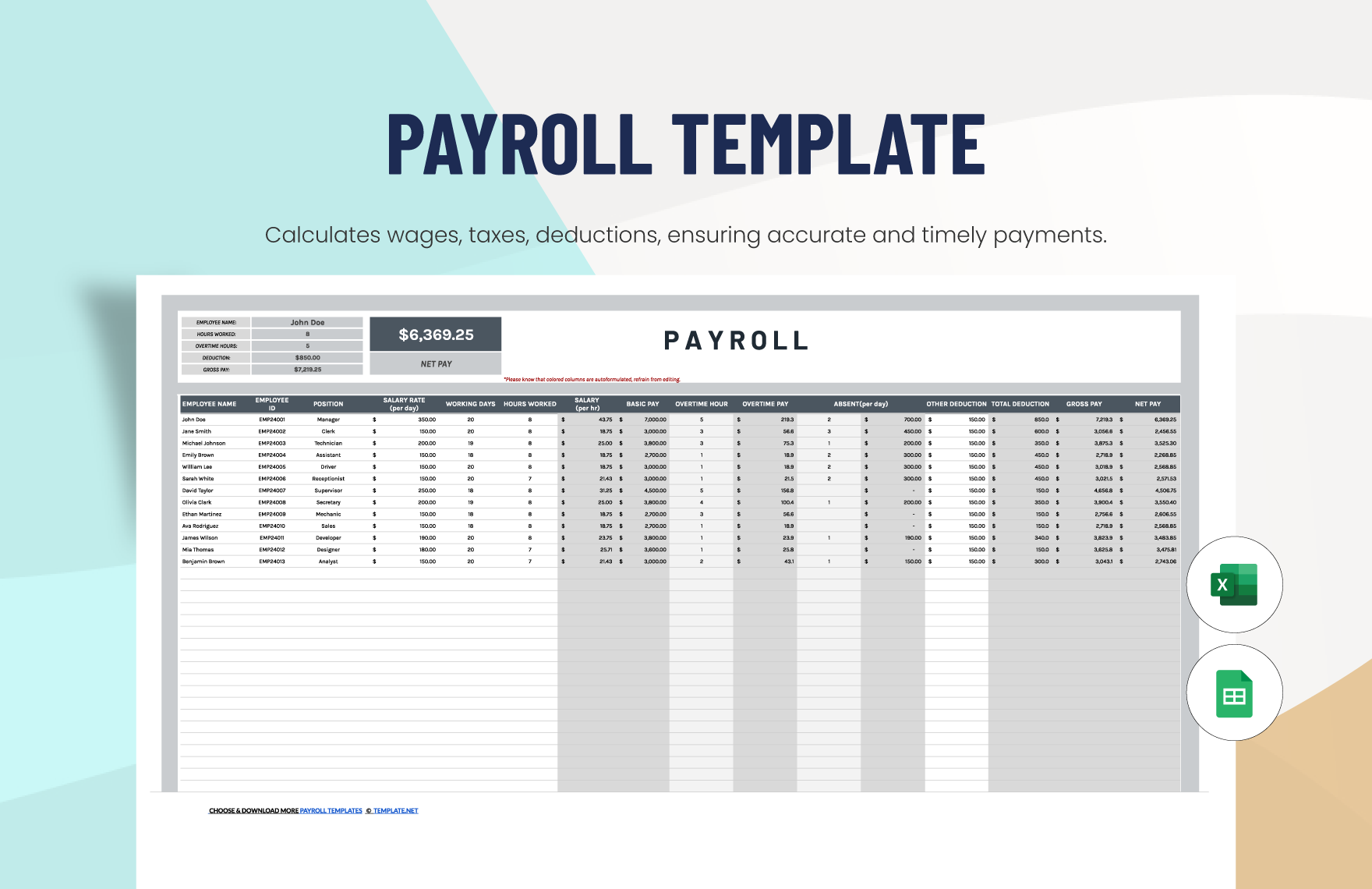

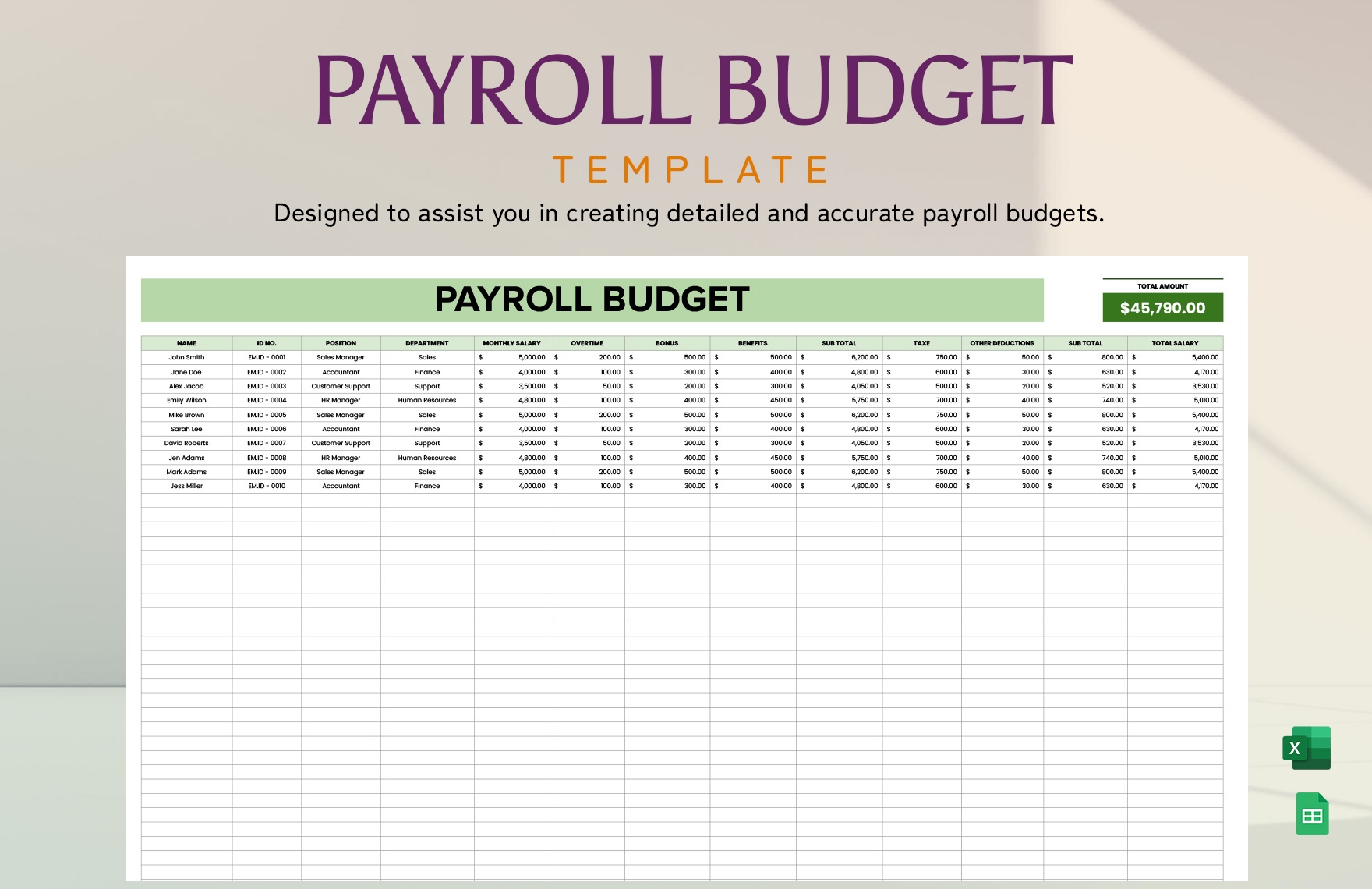

By using an Excel Payroll Template, businesses can easily input employee information, track hours worked, calculate wages, deductions, and taxes, and generate pay stubs. This eliminates the need for manual calculations and reduces the risk of errors in payroll processing.

Excel Payroll Template

One of the key advantages of using an Excel Payroll Template is its flexibility and customization options. Businesses can tailor the template to suit their specific needs, such as adding new columns for additional information or adjusting formulas to accommodate different pay structures.

In addition, Excel allows for easy data manipulation and analysis. Users can sort and filter data, create charts and graphs to visualize payroll trends, and generate reports for further analysis. This can help businesses make informed decisions and improve their payroll processes over time.

Another benefit of using an Excel Payroll Template is its cost-effectiveness. Excel is a part of the Microsoft Office suite, which is widely used in business environments. This means that businesses may already have access to Excel and can utilize its payroll templates at no additional cost.

Overall, an Excel Payroll Template can help businesses save time, reduce errors, and improve their payroll management processes. By taking advantage of Excel’s features and customization options, businesses can streamline their payroll operations and ensure accurate and timely payments to their employees.

In conclusion, utilizing an Excel Payroll Template can be a valuable tool for businesses looking to simplify and improve their payroll management processes. With its flexibility, customization options, and cost-effectiveness, Excel offers a practical solution for businesses of all sizes to efficiently manage their payroll operations.